FinOps for AI: Why Traditional Cost Management Doesn't Work Anymore

Why traditional cloud FinOps frameworks fail for AI workloads and how to build a specialized AI FinOps practice to optimize complex, usage-based costs.

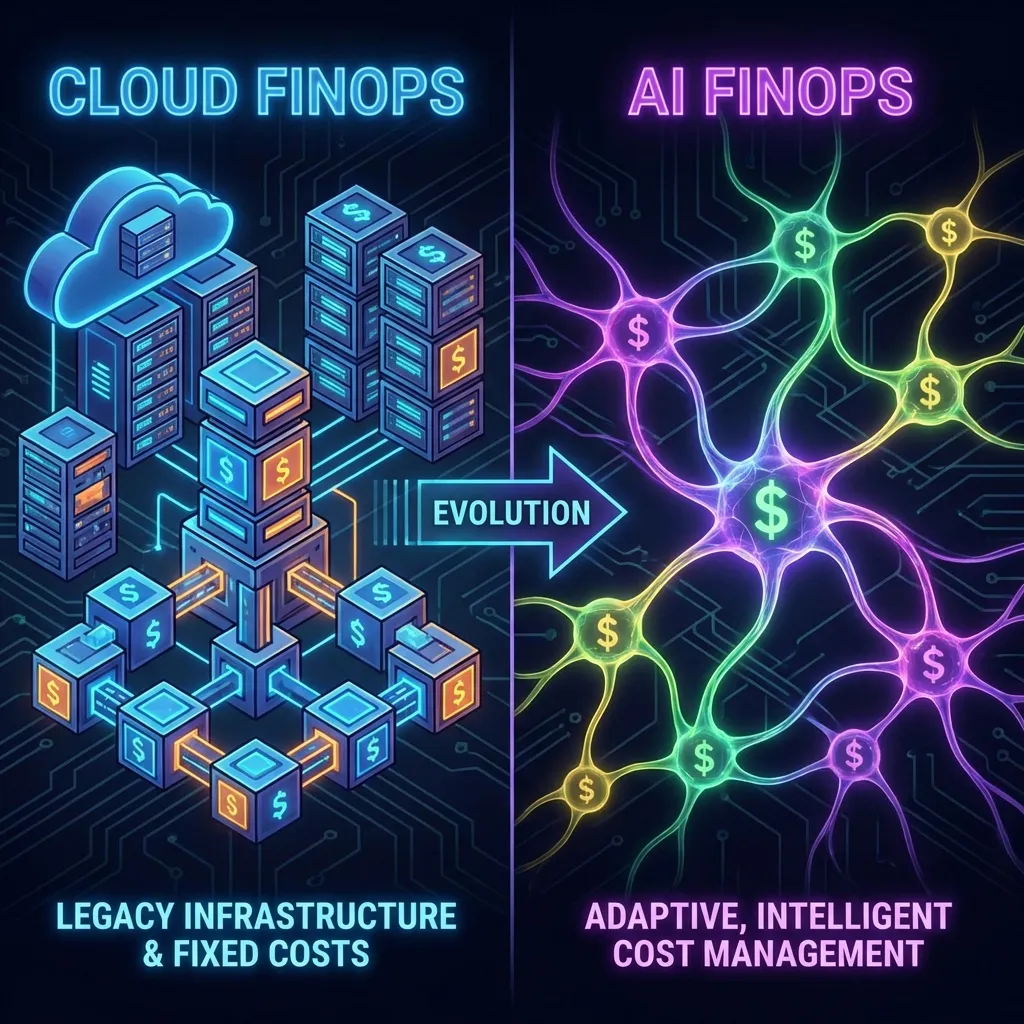

FinOps worked great for cloud infrastructure. Companies built sophisticated practices around optimizing AWS costs, rightsizing instances, and managing reserved capacity. But now those same companies are discovering that their FinOps playbook doesn’t translate to AI workloads. The assumptions are different, the cost drivers are different, and the optimization strategies are different.

This is creating a new category: FinOps for AI. It’s similar enough to traditional FinOps that the name makes sense, but different enough that you can’t just apply the same approaches. Companies that treat AI costs like cloud costs end up with blind spots, inefficiencies, and margin problems.

Why Cloud FinOps Doesn’t Work for AI

Traditional cloud FinOps focuses on infrastructure optimization. You look at your compute instances, your storage volumes, your database configurations. You find underutilized resources and rightsize them. You negotiate volume discounts. You use reserved instances to lock in lower rates. It’s fundamentally about getting more efficient with infrastructure spending.

AI costs don’t work this way. Sure, there’s infrastructure underneath, but that’s not where most of the cost variability comes from. Your AI costs are driven by usage patterns, prompt engineering choices, model selection, and application architecture. These are fundamentally different cost drivers that require different optimization approaches.

A cloud FinOps team might look at your AI spending and suggest moving to cheaper compute instances or negotiating better rates with your AI provider. But that misses the point. The real opportunities for optimization are in how you’re using AI, not in the infrastructure you’re using to access it. Are you using expensive models when cheaper ones would work? Are your prompts inefficient? Are you caching results? These questions don’t fit the traditional FinOps framework.

The Usage Based Nature of AI Costs

Cloud infrastructure costs are mostly capacity based. You provision resources and pay for that capacity whether you use it or not. You can optimize by matching your provisioned capacity more closely to your actual needs. It’s about avoiding waste.

AI costs are genuinely usage based. You pay per API call, per token processed, per inference request. There’s no unused capacity to optimize away. Every dollar spent represents actual usage. This changes the optimization game completely.

Instead of rightsizing capacity, you need to optimize usage patterns. Instead of negotiating volume discounts on infrastructure, you need to reduce the volume of expensive operations. Instead of turning off unused resources, you need to make your used resources more efficient. It’s a fundamentally different mindset.

Traditional FinOps metrics don’t apply well either. Concepts like utilization rate or idle resource cost don’t make sense for API based AI services. You need new metrics around cost per transaction, cost per user, cost per feature. You need to track the relationship between usage and value, not just the relationship between spending and capacity.

The Multi Model Complexity

Cloud FinOps deals with a relatively stable landscape of services. AWS, Azure, GCP. The services change gradually. Pricing is relatively predictable. Once you’ve optimized your cloud spend, it tends to stay optimized unless your usage patterns change dramatically.

AI is the opposite. New models are released constantly. Pricing changes frequently. A model that was the best choice last month might be obsolete this month. Providers introduce new tiers, new pricing models, new capabilities. The landscape is in constant flux.

This requires a completely different approach to financial governance. You can’t optimize once and forget about it. You need continuous monitoring and regular reevaluation. You need processes to assess new models as they’re released. You need to track pricing changes across multiple providers and understand their impact on your costs.

Most companies are using multiple AI providers. OpenAI for some workloads, Anthropic for others, maybe open source models for specific use cases. Each provider has different pricing, different capabilities, different strengths and weaknesses. Managing costs across this heterogeneous environment is much more complex than managing costs within a single cloud provider.

The Lack of Built In Tools

Cloud providers have invested heavily in cost management tools. AWS has Cost Explorer, billing alerts, and detailed tagging. Azure and GCP have similar capabilities. These tools aren’t perfect, but they give you a foundation for understanding and managing your spending.

AI providers are much earlier in their maturity. Most don’t provide sophisticated cost management tools. OpenAI gives you basic usage dashboards. Anthropic provides consumption data. But these are primitive compared to cloud provider tools. You don’t get detailed analytics, forecasting, anomaly detection, or optimization recommendations.

This means companies need to build their own tooling or use third party solutions. But most companies don’t have the resources to build sophisticated cost management tools from scratch. And the third party market is still immature. There are LLM ops platforms, but they’re focused more on performance and quality than on cost management.

The result is that most companies are managing AI costs with spreadsheets and manual processes. They export usage data, join it with pricing information, and try to make sense of it. This doesn’t scale. As AI spending grows, this manual approach becomes untenable.

The Organizational Challenge

Traditional FinOps often lives in a dedicated team or within finance. They work with engineering to implement optimizations, but the ownership and accountability is clear. FinOps is responsible for managing cloud costs.

AI cost management doesn’t fit neatly into any single team. It’s not purely an infrastructure problem, so it doesn’t naturally belong to the platform team. It’s not purely a financial problem, so finance can’t own it alone. It’s deeply tied to product decisions, so product needs to be involved. Engineering choices drive costs, so engineering needs accountability.

This creates organizational ambiguity. Who actually owns AI cost optimization? Who’s responsible when costs spike? Who makes decisions about trade offs between cost and quality? In most companies, the answer is “kind of everyone and kind of no one.” This diffusion of responsibility means optimization often doesn’t happen at all.

The companies that handle this well create cross functional ownership. They have representatives from engineering, product, and finance who meet regularly to review AI costs, make optimization decisions, and set priorities. They establish clear processes for how decisions get made and who has authority over different types of optimizations.

The Real Time Requirement

Cloud FinOps can often operate on a monthly cycle. You look at your bill at the end of the month, identify optimization opportunities, and implement changes for next month. There’s some urgency, but not that much. Costs are relatively predictable month to month.

AI costs are much more volatile. A bug in your code can cause costs to spike within hours. A new feature can drive unexpected usage within days. Power users can drive costs up 10x before you even notice. By the time the monthly bill arrives, significant damage may already be done.

This requires real time or near real time cost visibility. You need to know today what your spending trajectory looks like this month. You need alerts when costs deviate from expected patterns. You need the ability to respond quickly to cost issues before they become expensive problems.

Most traditional FinOps tools and processes aren’t built for this pace. They’re designed for monthly review and optimization cycles. Adapting them to real time AI cost management requires new capabilities, new tools, and new processes. It’s not just an incremental change, it’s a fundamental shift in how financial governance operates.

The Strategic Importance

Here’s why AI FinOps matters more than traditional cloud FinOps for many companies. Cloud infrastructure is a cost center, but it’s usually a manageable percentage of revenue. For most SaaS companies, cloud costs are 10 to 20% of revenue. Important, but not existential.

For AI native companies, AI costs can be 30 to 50% of revenue or more. It’s not just the biggest cost category, it’s often the determining factor in whether the business model works at all. If you can optimize AI costs by 20%, that might translate directly to 10 points of additional gross margin. That’s the difference between a healthy business and a struggling one.

This means AI cost management isn’t just an operational efficiency thing. It’s a strategic imperative. Companies that get really good at managing AI costs will have fundamentally better unit economics than competitors. They’ll be able to price more aggressively, invest more in features, and grow more sustainably.

This strategic importance means AI FinOps deserves senior leadership attention in a way that cloud FinOps often doesn’t. CFOs, CTOs, and CEOs need to understand AI cost dynamics, track key metrics, and ensure the organization has the capabilities needed to manage these costs effectively.

Building AI FinOps Capabilities

If you’re building AI FinOps capabilities, start with visibility. You need instrumentation to track AI costs at a granular level. Tag every API call with metadata about what it’s serving. Build dashboards that show costs by feature, by user segment, by time period. You can’t optimize what you can’t measure.

Next, establish governance processes. Who approves new AI features? What’s the process for evaluating new models? How do you decide when to implement rate limiting or usage caps? These decisions need clear ownership and systematic evaluation, not ad hoc reactions.

Invest in experimentation capabilities. You need the ability to test different models, different prompt strategies, different architectures, and understand the cost implications. This requires good eval frameworks, the ability to run controlled experiments, and clear ways to measure success.

Build cost forecasting models. Understand your usage patterns and how they drive costs. Create models that project future spending based on growth assumptions. Track leading indicators that predict cost changes before they show up in the bill. This gives you the ability to be proactive rather than reactive.

Finally, create a culture of cost awareness. Every engineer making decisions about AI implementation should understand the cost implications. Every product manager launching a new feature should consider the unit economics. This doesn’t mean being cheap. It means being intentional about where you spend and ensuring the value justifies the cost.

The Emerging Ecosystem

The good news is that an ecosystem is emerging to support AI FinOps. LLM ops platforms are adding cost monitoring features. Specialized cost intelligence tools are being built specifically for AI workloads. Cloud providers are starting to offer better visibility into AI spending.

But we’re still early. The tools are immature. The best practices are still being figured out. The companies that invest in building AI FinOps capabilities now will have a significant head start. They’ll develop the processes, tools, and organizational capabilities that will become standard in a few years.

For companies just starting to think about this, the key is to start simple but start now. Don’t wait until you have the perfect solution designed. Implement basic cost tracking. Build simple dashboards. Establish lightweight governance processes. Then iterate and improve as you learn what you actually need.

AI FinOps is becoming a core capability for any company building on AI infrastructure. The companies that treat it seriously, invest in the right capabilities, and build the right organizational structures will have a massive advantage. The ones that try to apply traditional FinOps approaches or ignore the problem will struggle with escalating costs and eroding margins.